|

Income Tax Service |

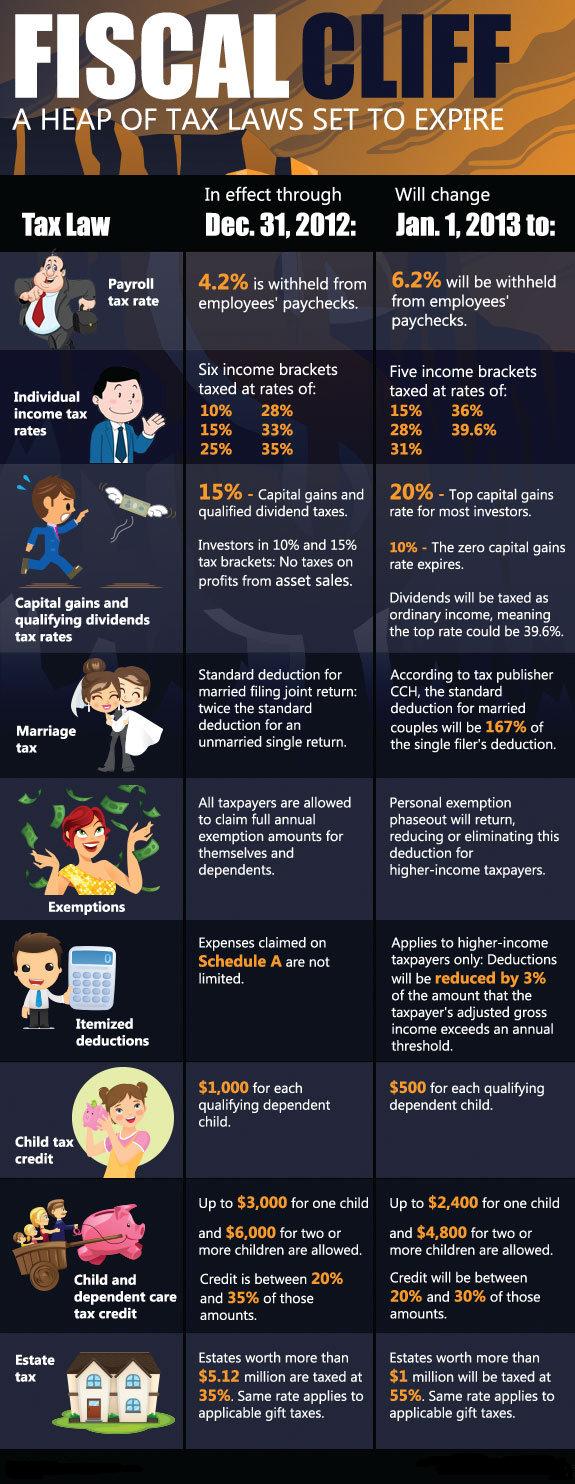

Americans are right on the edge of toppling over the so-called "fiscal cliff" -- the financial precipice that lawmakers must negotiate as various tax increases and spending cuts are scheduled to automatically go into effect unless Congress takes action before Dec. 31.

Below are some key provisions that, without further legislative action, will change dramatically next year.

NOTE: The Payroll tax rate discussed is the FICA withholding amount, commonly called Social Security Tax that an individual pays. The employer's rate remains at 6.2%. For two years, Congress has had you paying 2% less into the already at-risk Social Security system. Ultimately this may decrease the Social Security benefit amount you will receive when you retire.