5200 W Market St

Greensboro, NC 27409

336-852-9505

Terry Hough

Terry Hough

President

|

Income Tax Service

5200 W Market St Greensboro, NC 27409 336-852-9505 |

Terry Hough

Terry Hough

President |

The Exchange (also known as the Marketplace, the SHOP and the Store) offers consumers insurance choices in Bronze, Silver, Gold or Platinum policies. The different metal policy designation illustrates the estimated actuarial coverage of medical costs at 60% for Bronze, 70% for Silver, 80% for Gold and 90% for Platinum. The Bronze and Silver policies both appear to accomplish this goal through very high deductibles of usually $5,000-$6,000 per person, $12,000 family.

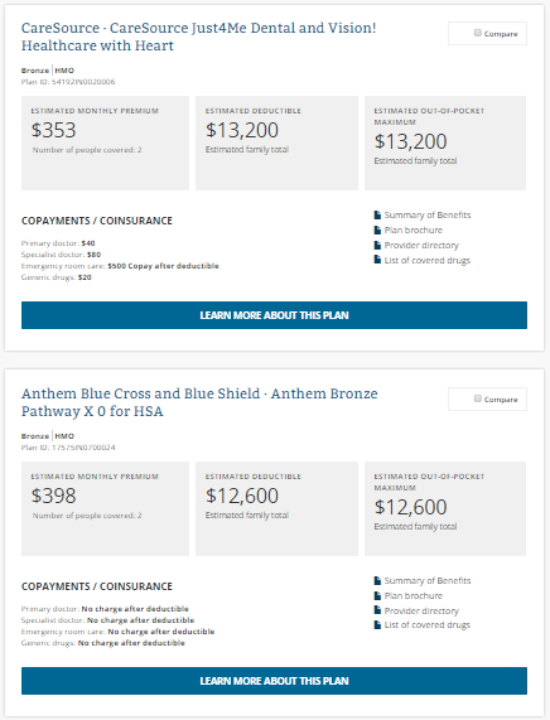

Using an average family of 2 people age 35 and 34 with family income of $100,000, we went to www.Healthcare.gov to look at premiums. Here is a screen shot of what we found:

Many taxpayers would go for the first plan because it is $45 cheaper per month, but we think that is a terrible mistake in most cases where the taxpayer incurs some minimum medical bills. First the $45 extra monthly premium is offset if the taxpayer hits the maximum deductible. More importantly, the dramatic differences are illustrated below.

Letís assume the taxpayer incurs $5,000 in medical bills in 2015 in both following examples. We have been discussing this planning idea.

Example 1

Under the conventional policy listed first this family would obtain no tax

deduction for medical costs because their income is $80,000. This means their

total medical costs for the year would be $5,000 plus (12x353) = $4,236 or

$9,236 in total.

If the family purchased the 2 nd HSA policy they would be able to contribute $5,000 to the HSA (or more since the 2015 family contribution limit is over $6,500). This contribution is deductible before AGI, also allowing them greater temized deductions. Assuming a 25% combined tax bracket their out of pocket costs would be $5,000 plus [(12x398) x.75] = $3,582 or $8,582 in total for a nearly $700 savings. They would also have the ability to deposit the remaining balance of the 2015 HSA contribution into the account of they wished. The withdrawal from the account would normally be tax-free if used for qualified medical expenses.

Trap The HSA may only reimburse for medical costs incurred since the health savings account was first opened, so all Americans with HSAís must "start the clock" by depositing and keeping at least $1 in the Health Savings Account as soon as possible. This means that all costs incurred since the first $1 was deposited may be reimbursed tax free at any time. See IRS Notice 2004-2, Q&A #26.

Example 2

An even better tool is available in certain circumstances. Letís say the couple

above incurs $5,000 in medical bills, has a Health Savings Account with only

the $1 in it, and has no free cash except an IRA with $10,000. If the couple

takes $5,000 out of their IRA to pay the medical bill they will owe tax and

penalty on the $5,000, receive no medical deduction, and need to withdraw more

than $5,000 just to have that much left after tax.

However, we have a plan! IRS Notice 2008-51 allows a one-time tax-free transfer from an IRA to the health savings account as long as the individual qualifies to make a contribution to the HSA. The transfer is limited to the maximum contribution for the year and is reduced by any contributions already made, so do it in a year when nothing has been deposited to the HSA and there is enough in the IRA to transfer the maximum annual contribution. In a future year the spouse can do the same thing, allowing for a maximum IRA to HSA transfer of over $13,000 tax and penalty free.

So using the Exchange, with our tax knowledge, you have saved literally hundreds of dollars, obtained the only known IRA tax-free distribution available, and paid for our tax preparation fee many times over!